Beginner Mistakes Filipinos Make With Travel Rewards (Reddit Edition)

From overspending to expired miles, here are the most common travel rewards mistakes Filipinos admit on Reddit — and how to avoid them.

Expert analysis and insights on Philippines banking, finance, investments, and digital financial services. Stay informed with the latest market trends, regulatory updates, and strategic financial guidance.

From overspending to expired miles, here are the most common travel rewards mistakes Filipinos admit on Reddit — and how to avoid them.

Travel points feel rewarding, but they can quietly change spending behavior. Learn why travel rewards make people overspend — and how to avoid it.

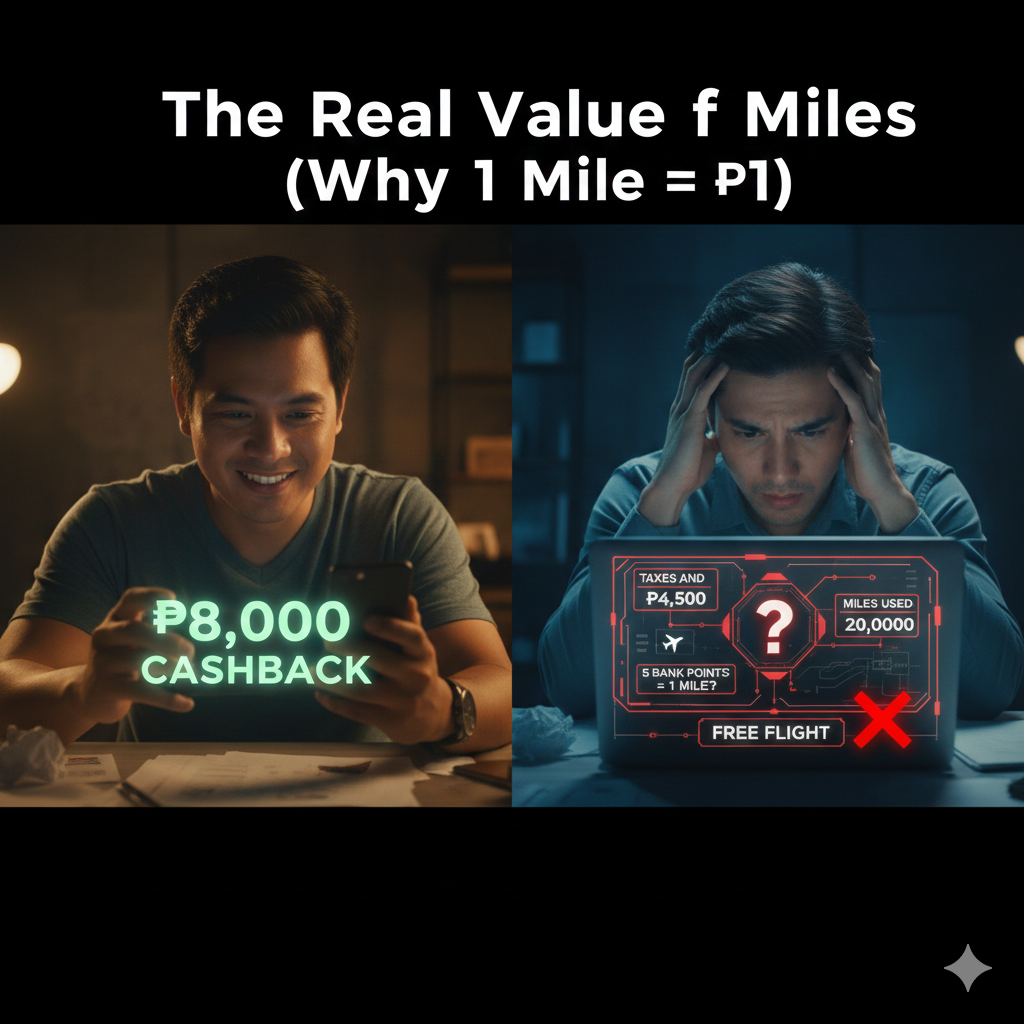

Think airline miles are equal to pesos? Learn the real value of miles in the Philippines and why many redemptions disappoint beginners.

Only travel once a year? Learn whether travel credit cards actually make sense for Filipinos who don't fly often — without hype or pressure.

Cashback or miles? This practical guide explains which credit card rewards actually make sense for Filipino travelers — especially beginners.

Confused about travel points? This beginner-friendly guide explains how credit card travel points actually work in the Philippines — without hype...

Bank app down or customer support unresponsive? Learn how Filipinos should protect their money and respond calmly when banking systems fail.

Credit card delivery delayed or incorrect? Learn what Filipinos should do when cards don't arrive, arrive late, or have errors.

Think credit cards are always bad? Or that minimum payments are safe? Learn the most common credit card myths Filipinos still believe — and the t...

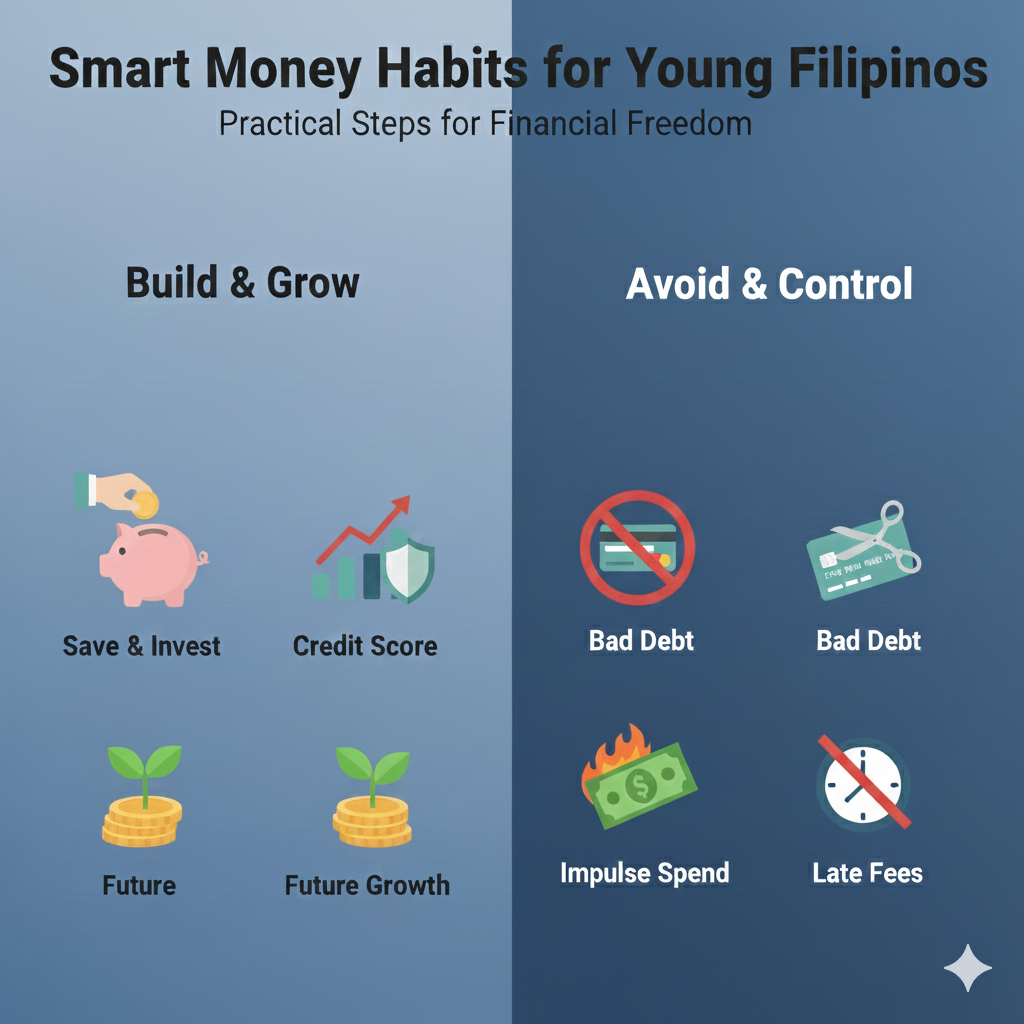

Not sure if your credit card is helping or hurting you? Learn how Filipinos can assess whether credit cards are improving or damaging their finances.

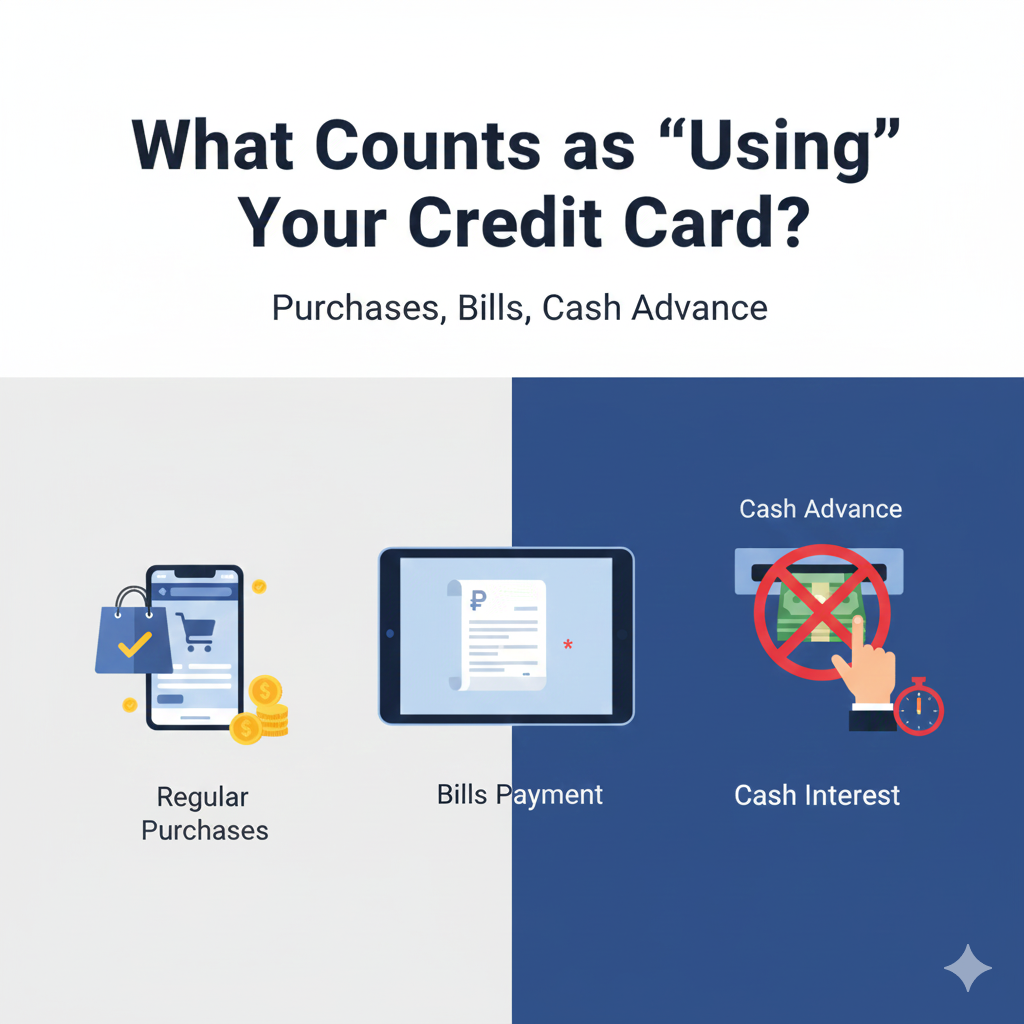

Want to pay bills with your credit card in the Philippines? Learn how to do it safely, avoid extra fees, and prevent bill payments from turning int...

Credit card rewards can backfire. Learn why chasing points and cashback often leads Filipinos to spend more than planned.

Is one credit card enough? Learn how many credit cards Filipinos actually need — and when having more helps or hurts.

No annual fee sounds great — but is it always better? Learn the real pros and cons of NAFFL credit cards in the Philippines.

Can you pay bills with a credit card in the Philippines? Learn which cards work best, what fees to watch for, and when it's worth it.

Are credit card rewards really worth it? This honest guide explains when rewards help — and when cashback is the smarter choice.

Looking for your first credit card? Here are the best beginner credit cards in the Philippines for 2026, plus how to choose the right one safely.

Cashback or rewards? Learn what Filipino credit card users actually prefer — and which option makes sense for beginners.

Not sure which credit card to keep? Learn how Filipinos can decide which cards are worth keeping — and which ones to cancel safely.

Feeling anxious about your first credit card? Learn why that fear exists and how Filipinos can use credit confidently.

From minimum payments to overspending, here are the most common credit card mistakes Filipinos admit and how to avoid them.

Is it smart to use your credit card for all expenses? Learn when it works and when it quietly backfires for Filipinos.

You don't need multiple credit cards. Learn how Filipinos can manage just one credit card efficiently without falling into debt.

Is paying the minimum on your credit card really that bad? Learn what actually happens to your money and debt over time.

Does paying bills count as credit card usage? Learn which transactions earn rewards, trigger fees, or accrue interest.

Confused by credit card due dates? Learn why many Filipinos still get charged interest and how to avoid it permanently.

Just got your first credit card? Learn exactly what Filipinos should do first to avoid debt, build credit, and stay in control.

Meet Carlos, a freelance developer who turned thousands in monthly business expenses into free gadgets using credit card rewards. Learn his strateg...

The Philippines is going through a quiet money revolution. From government changes to pandemic habits that stuck around, here's why Filipinos are s...

Registered Financial Planner Mariel Bitanga shares lessons from 10 years helping Filipinos navigate credit cards and debt, including her own strugg...

Meet Maria, a professional who discovered credit card rewards and now pays for 80% of her flights using miles. Learn her strategy for maximizing po...

Learn 12 practical credit card strategies for Filipinos to maximize cashback, points, and rewards across different banks and categories in 2025.

Discover how Filipinos can save ₱8,000+ a year by identifying and avoiding hidden credit card fees. Learn strategies to beat annual, forex, and l...

Discover the strategic banking approach that smart Filipinos use to maximize wealth. Learn how to combine digital and traditional banks for optimal...

A simple, automated credit card system using BDO, BPI, RCBC, and Security Bank that delivers consistent rewards, lower fees, and better financial o...

Complete guide to choosing your first credit card in the Philippines. Learn which starter cards work best for ₱15,000-₱20,000 earners, how to a...

Cut through the credit card jargon with our simple guide to APR, finance charges, and interest rates in the Philippines. Learn how BDO, BPI, RCBC, ...