What to Do When Your Credit Card App or Bank Support Fails

Bank app down or customer support unresponsive? Learn how Filipinos should protect their money and respond calmly when banking systems fail.

"At Least I Paid Something" Is a Trap

I still remember a conversation with a college friend.

He had a ₱15,000 credit card balance from a Lazada sale season budol. Every month, he religiously paid the minimum. ₱600. Sometimes ₱750.

"At least I'm being responsible," he told me. "I never miss a payment."

Six months later, he still owed ₱13,800.

He'd paid over ₱4,000 total. His balance had only gone down by ₱1,200.

Where did the rest of his money go? Straight to the bank as interest.

Here's what many Filipinos believe. As long as you pay the minimum, you're being responsible. You're avoiding late fees. You're doing the right thing.

Technically true, but financially dangerous.

Paying the minimum keeps you out of trouble with the bank. But it keeps you in debt for years. Most of your payment goes to interest, not to actually reducing what you owe.

This article breaks down what really happens behind the scenes when you pay the minimum versus paying in full. The numbers might shock you.

Let's start with the basics. What is the minimum payment?

The minimum amount due is typically around 3% to 5% of your outstanding balance, or a fixed floor like ₱500 to ₱1,000, whichever is higher.

So if you owe ₱20,000, your minimum might be ₱1,000 (5% of ₱20,000).

If you owe ₱8,000, your minimum might still be ₱500 (the fixed floor).

BPI's explainer on the Minimum Amount Due explicitly states that paying only the MAD increases finance charges and lengthens the time it takes to pay off your debt. They actually encourage cardholders to pay more than the minimum.

But here's what most people don't realize. The minimum payment is designed to cover mostly interest, with just a tiny sliver going toward reducing your actual debt.

Let me show you the math with an example.

You have a ₱100,000 balance. Your bank charges 3% monthly interest (around the BSP cap, which works out to roughly 36% per year). Your minimum payment is 5%, so ₱5,000.

Month 1:

You pay ₱5,000

Interest charges: ₱3,000 (3% of ₱100,000)

Amount that actually reduces your debt: ₱2,000

New balance: ₱98,000

So out of your ₱5,000 payment, only ₱2,000 went toward your actual debt. The other ₱3,000 went straight to the bank as interest.

Month 2:

You pay ₱4,900 (5% of ₱98,000)

Interest charges: ₱2,940 (3% of ₱98,000)

Amount that reduces your debt: ₱1,960

New balance: ₱96,040

Month 3:

You pay ₱4,802 (5% of ₱96,040)

Interest charges: ₱2,881 (3% of ₱96,040)

Amount that reduces your debt: ₱1,921

New balance: ₱94,119

Do you see the pattern? After three months, you've paid ₱14,702 total. But your balance has only gone down by ₱5,881. The rest, over ₱8,800, went to interest.

This is standard revolving credit behavior. When you pay only the minimum, most of each payment covers interest rather than principal. This keeps the debt alive for years.

Here's another example: ₱20,000 balance, 3% monthly interest, minimum payment ₱600. Most of that ₱600 covers interest. Your debt barely moves.

This is why balances linger for years. You're not lazy. You're not irresponsible. You're just trapped in a system designed to extract maximum interest from minimum payments.

Now let's look at what happens when you pay in full.

The BSP's credit card primer is crystal clear on this. You pay no finance charge if you pay the Total Amount Due in full on or before the Payment Due Date. And you only enjoy the full grace period if you have no unpaid balance from prior cycles.

Translation: pay your full statement balance every month, and you pay zero pesos in interest. Ever.

Here's the same scenario, but with full payment.

You have a ₱20,000 balance on your statement. Your due date is in 20 days.

You pay ₱20,000 in full before the due date.

Interest charged: ₱0.

New balance: ₱0.

Next month, you use your card again. Let's say ₱15,000 in new purchases. You pay that in full before the due date.

Interest charged: ₱0.

This is how disciplined credit card users operate. They use the card for convenience, rewards, and tracking expenses. But they never carry a balance. They never pay interest.

Nicole, a 30-something year old, puts literally everything on her BDO card. Groceries, utilities, Grab rides, online shopping, subscriptions.

She's never paid a single peso in interest. Why? Because she pays in full every single month.

The card gives her cashback. It gives her purchase protection. It simplifies her expense tracking. And it costs her nothing because she treats it like a debit card.

Paying in full:

Learn how to maximize benefits:

How to Use One Credit Card Like a ProLet's zoom out and look at the long-term damage.

Going back to that ₱100,000 example. You pay the minimum every month at 5% of your balance. Interest is 3% per month.

How long will it take to pay off that debt? And how much will you pay in total?

If you only pay the minimum, you'll be in debt for years. The exact timeline depends on your specific minimum percentage and interest rate, but the pattern is brutal.

Here's a rough estimate based on Philippine rates:

Original debt: ₱100,000

Monthly interest: 3% (36% per year, around the BSP cap)

Minimum payment: 5% of balance

If you never add new charges and just pay the minimum every month, you could be paying for 5+ years. And your total payments could exceed ₱150,000 to ₱180,000.

You're paying an extra ₱50,000 to ₱80,000 in interest on a ₱100,000 debt. Just because you chose minimum payments.

Let's look at a smaller, more relatable example.

You have a ₱20,000 balance from a Shopee midnight sale budol. Let's say your minimum is ₱600, and your card charges 3% monthly interest.

Paying minimum only:

Paying in full immediately:

Same debt but wildly different outcomes.

Sofia learned this the hard way. She had a ₱40,000 balance from furnishing her condo. Paid minimum for two years because "that's all I can afford."

By the time she finally cleared it, she'd paid over ₱60,000 total. That's ₱20,000+ in pure interest.

She could have paid it off in 6 to 8 months if she'd just committed to larger payments early on. Instead, she stretched it to two years and paid 50% more than the original amount.

Learn from real mistakes:

Common Credit Card Mistakes Filipinos Admit on RedditLet's be blunt about this. Minimum payments are incredibly profitable for banks.

When you pay the minimum, you're essentially volunteering to pay interest for months or years. The bank makes money every single month you carry a balance.

According to BSP regulations and summaries, the caps on credit card interest exist because high revolving interest makes long-term borrowing extremely expensive. Even with the cap, 3% per month is steep.

But here's the thing. The bank doesn't force you to pay minimum. They just make it seem like the responsible option.

Your statement shows two numbers. Total Amount Due: ₱20,000. Minimum Amount Due: ₱600.

For someone stressed about money, ₱600 feels manageable. ₱20,000 feels impossible.

So they pay ₱600. And the bank wins.

Minimum payments keep you in the system. They keep you generating interest. They keep you as a profitable customer.

Making only minimum payments keeps your credit utilization high and can hurt your credit score over time. Plus, the compound interest keeps your debt growing if you continue using the card.

Every month you pay the minimum is another month they collect interest.

Okay, let's be realistic. There are rare situations where paying the minimum might be your only option in the short term.

Genuine emergencies:

Temporary income disruptions:

In these cases, paying the minimum keeps you from getting hit with late fees and keeps your account in good standing while you figure things out.

But even then, it should be temporary. Not a long-term strategy.

Carlo went through this when he lost his job in 2020. He had a ₱25,000 credit card balance and couldn't pay in full for three months while he was job hunting.

He paid the minimum to avoid late fees. But as soon as he got a new job, he made it his priority to pay off that balance as fast as possible. He cleared it within four months of starting his new position.

That's the key. Minimum payments in an emergency? Fine, if absolutely necessary. But you need a plan to get out of minimum payment mode as quickly as possible.

Here's the rule: If you find yourself paying minimum for more than 2 to 3 months, you're not in temporary emergency mode anymore. You're in long-term debt mode. And you need to make serious changes.

Stop using the card. Cut expenses elsewhere. Find ways to increase income. Do whatever it takes to start paying more than the minimum.

Check out our guide:

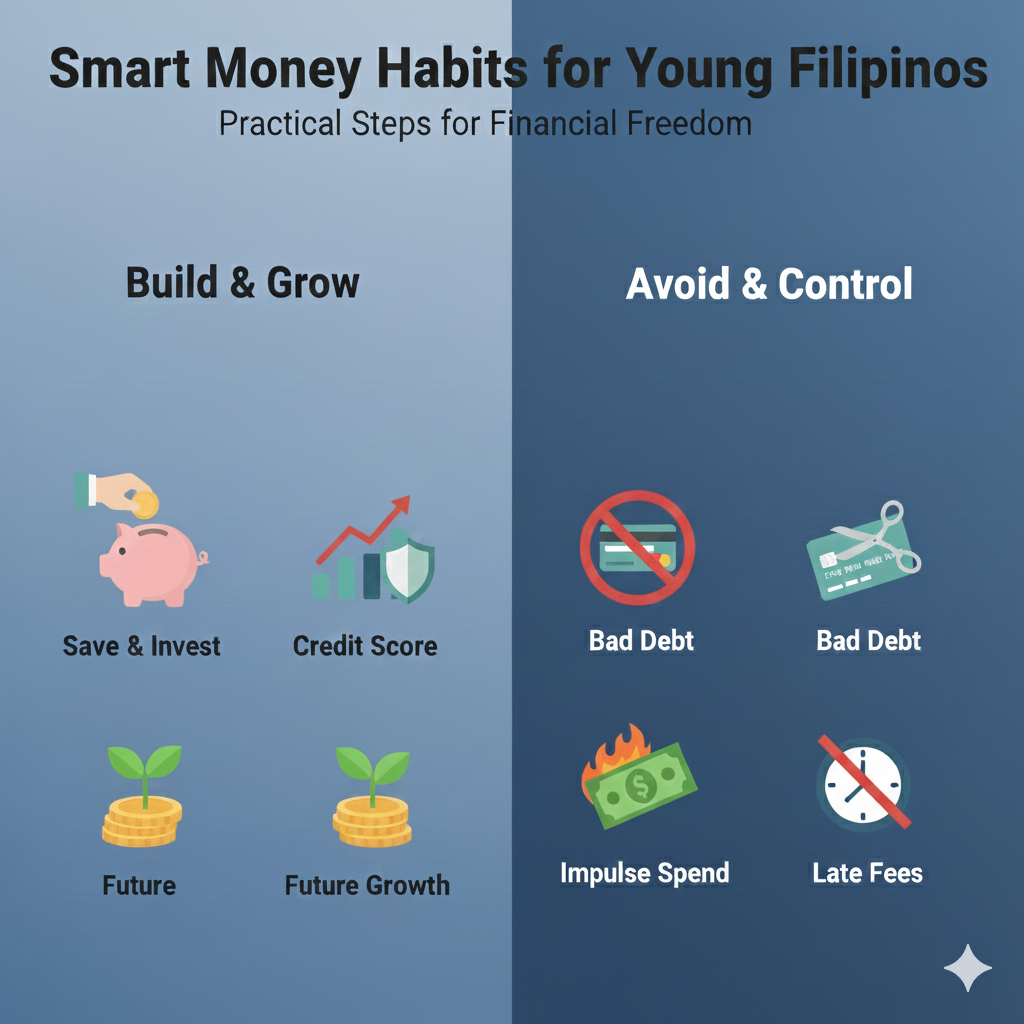

Smart Money Habits for Young FilipinosHere's something critical that most people don't understand. The grace period only works if you pay your full balance.

You enjoy the full benefit of the grace period only if there is no unpaid balance from the previous billing cycle.

What does this mean in practice?

Let's say your statement date is January 15, and your due date is February 5. You have ₱10,000 in new purchases on that statement.

Scenario 1: You pay in full (₱10,000) by February 5

Scenario 2: You pay ₱8,000 by February 5

Once you carry any balance, even ₱100, you lose the grace period on all new purchases. They start accumulating interest from the transaction date.

This is the trap within the trap. You think you're being smart by paying ₱8,000 out of ₱10,000. You paid most of it, right?

But now every new purchase you make in February starts earning interest immediately. No grace period. No interest-free float.

So that ₱5,000 in new purchases you make in February? They're already accumulating 3% monthly interest from day one, even though the February statement hasn't even been issued yet.

This is how people get stuck in a cycle. They carry a small balance, lose their grace period, new purchases start earning interest immediately, the balance grows faster than they realize.

Pro tip: If you've been paying minimum or carrying a balance, the first step to breaking the cycle is to pay your total amount due in full, even if it hurts. Get back to zero. Regain your grace period. Then commit to paying in full every month going forward.

There's a dangerous mindset that traps people in minimum payment mode.

"I can afford ₱500 a month. That's manageable."

Yes, ₱500 is manageable. But that's not the question you should be asking.

The real question is: can you afford to pay ₱20,000+ in total for a ₱15,000 purchase?

Because that's what you're actually committing to when you only pay the minimum.

Philippine financial education pieces emphasize that most issuers set minimum payments at 3% to 10% of your bill, which feels affordable. But that affordability is an illusion if you're paying 50% to 100% more than the original amount over time.

I've seen this pattern so many times. Someone gets a credit card. They swipe for everything because "I'll just pay the minimum if I need to."

₱5,000 here. ₱8,000 there. ₱12,000 for a weekend trip.

Before they know it, they're carrying a ₱30,000 balance. Minimum payment is ₱900. "That's fine, I can afford ₱900."

But they never ask: can I afford to stay in debt for 5+ years and pay ₱45,000 total for ₱30,000 in purchases?

Here's the mindset shift: Don't ask if you can afford the minimum. Ask if you can afford to pay the full balance within 1 to 2 months max.

If the answer is no, don't make the purchase.

Your credit card is not extra money. It's a payment method for things you can already afford.

If you're currently stuck in minimum payment mode, here's how to get out.

Step 1: Stop using the card immediately. You can't dig yourself out of a hole while you're still digging. Stop adding new charges. Put the card in a drawer or freeze it in a block of ice if you have to.

Step 2: Figure out your total debt. Log into your account. Check your current balance. Write it down. Face it head-on.

Step 3: Calculate how much you're actually paying in interest. Multiply your balance by your monthly interest rate (usually around 3%). That's how much you're paying every month just to stay in debt.

Step 4: Create a payment plan. How much can you realistically pay every month? Not the minimum. How much can you scrape together if you cut other expenses?

Step 5: Pay as much as possible, as fast as possible. Even if you can only pay ₱2,000 instead of the minimum ₱600, that's ₱1,400 more going to your principal. The faster you pay, the less total interest you'll pay.

Step 6: Once you clear the debt, commit to paying in full forever. Never carry a balance again. Use the card only for things you can afford to pay off immediately.

Kim was stuck with a ₱35,000 balance. She'd been paying minimum (around ₱1,000) for 8 months and her balance was still ₱32,000.

She got serious. Stopped using the card. Sold some stuff she didn't need. Picked up freelance work on weekends. Started paying ₱5,000 to ₱7,000 per month.

She cleared the entire balance in 6 months. Total interest paid was still significant, but way less than if she'd continued paying minimum for years.

Now she uses her card only for groceries and gas. She pays in full every month and never carries a balance.

People avoid paying in full because they think they can't afford it.

But let's flip the question. What does paying in full actually cost you compared to paying minimum?

Example: ₱15,000 balance

Option 1: Pay minimum only (₱500/month at 3% interest)

Option 2: Pay in full immediately

The difference is ₱10,000.

By paying minimum, you're choosing to pay ₱10,000 extra over 3+ years. That's the real cost.

Now, I understand. Not everyone has ₱15,000 sitting around to pay off a balance immediately.

But here's the thing. If you don't have ₱15,000, you shouldn't have charged ₱15,000 in the first place.

And if you did charge it (maybe it was an emergency), you need a plan to pay it off in 2 to 3 months max, not 40 months.

Compound interest on credit card debt can double or triple what you owe if you only pay minimum amounts and continue using the card. The longer you stay in minimum mode, the more expensive your original purchases become.

The takeaway: Paying in full doesn't cost you extra. It costs you the original amount and nothing more. Paying minimum costs you 50% to 100% extra in interest over time.

Which one sounds more affordable now?

Remember Miguel from the beginning? The one who thought he was being responsible by paying the minimum every month?

He eventually realized the trap he was in. After 6 months of minimum payments, he'd paid over ₱4,000 and barely made a dent in his balance.

He stopped using the card. Started paying ₱3,000 to ₱4,000 per month instead of the ₱600 minimum. Cleared the entire debt in 5 months.

Total interest paid was still significant. But nowhere near what it would have been if he'd continued paying minimum for years.

Minimum payments keep you in the system. They keep you generating interest for the bank. They keep you in debt.

Paying in full gives you control. It turns your credit card into a tool that works for you, not against you.

Yes, paying in full requires discipline. It requires you to only spend what you can actually afford. It requires you to treat your credit card like a debit card.

But that discipline is what separates people who use credit cards successfully from people who end up drowning in debt.

The choice is yours. Pay the minimum and stay in debt for years, paying double or triple the original amount. Or pay in full and enjoy all the benefits of a credit card (rewards, convenience, purchase protection) with zero interest charges.

One path delays your financial freedom and the other path protects it. Choose wisely.