For Carlos, credit cards seemed like a trap designed to put people in debt. So he avoided them entirely.

"I grew up hearing stories about people drowning in credit card debt," he recalls. "My parents always said, 'If you can't afford it, don't buy it.' So I just used my debit card for everything and thought I was being responsible."

Then Carlos started freelancing on the side. Suddenly, he had real business expenses: web hosting, software subscriptions, client dinners, and coworking space memberships. Thousands of pesos are flowing out of his account every month.

All on his debit card. Earning him absolutely nothing in return.

The Wake-Up Call

The realization hit him during a conversation with a client who casually mentioned he'd just "earned" a new laptop through credit card rewards.

"I thought he was joking," Carlos says. "But he showed me his points balance. He'd been putting all his business expenses on a cashback card, and after a year, he had enough to buy a MacBook Pro at a massive discount."

That's when it clicked. Carlos wasn't being financially responsible by avoiding credit cards. He was leaving money on the table.

Three weeks later, he applied for his first card.

The Strategy: Separate Personal and Business

Unlike casual credit card users, Carlos needed a system. As a freelancer with fluctuating income and significant business expenses, he couldn't afford to mix his personal and professional spending.

His solution: two different cards with different reward structures.

Card #1: Business Expenses (Cashback Focus)

For his recurring business costs - software subscriptions, domains, client meals, equipment - he chose a card with flat-rate cashback on all purchases. It was simple, predictable, and perfect for tracking deductible expenses.

Card #2: Personal Spending (Lifestyle Rewards)

For everything else, he picked a card that gave bonus points on dining, entertainment, and online shopping. "I'm not traveling much for pleasure, so miles didn't make sense," he explains. "I wanted rewards I'd actually use."

The key insight: Don't get caught up in flashy sign-up bonuses if the everyday rewards don't match your lifestyle.

The Rookie Mistake That Almost Derailed Him

Carlos's first month with a credit card was smooth. The second month was not as smooth.

"I put a big client project deposit on my card - about ₱60,000 - planning to pay it off once I got paid," he says. "But the client delayed payment by three weeks, and suddenly my credit card bill was due before I had the cash."

He panicked and paid the minimum. As a result, he got hit with interest charges.

"That's when I learned about cash flow management the hard way," he admits. "Now I never charge something to my card unless the money is already sitting in my account or I know exactly when it's coming in."

His rule now: If you're self-employed or freelance, always maintain a buffer in your bank account equal to your highest monthly credit card spend. Never float expenses hoping your income arrives on time.

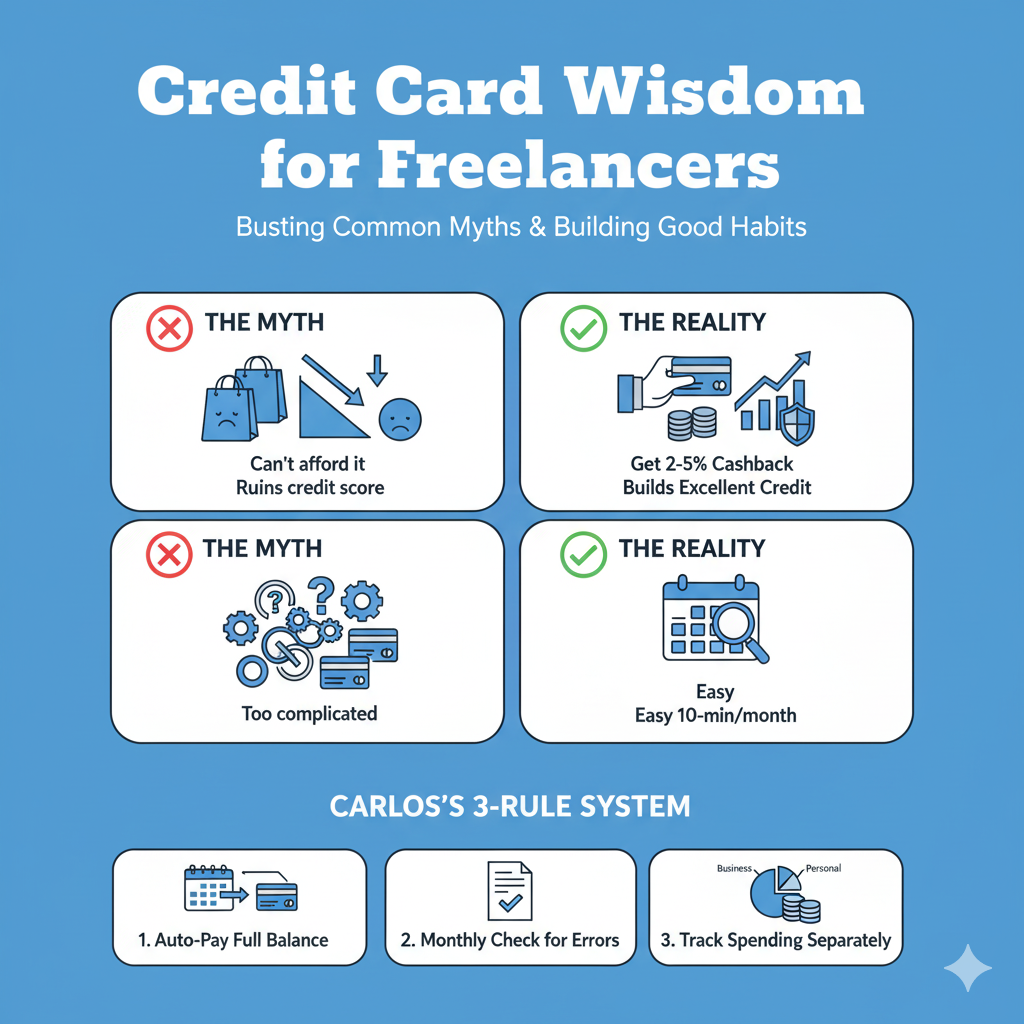

Busting the Myths That Held Him Back

Looking back, Carlos realizes several myths kept him from using credit cards strategically for years.

Myth #1: "Credit cards are for people who want to buy things they can't afford."

His take: "I was already spending the money. The only difference is now I get 2-5% back. That's thousands of pesos a year I was just throwing away by using my debit card."

Myth #2: "Credit cards will ruin your credit score."

The reality: "It's the opposite. My credit score went from basically nonexistent to 'excellent' within 18 months just by paying on time every month. Now I qualify for better rates on everything."

Myth #3: "Managing credit cards is complicated."

Carlos's response: "I spend maybe 10 minutes a month checking my statements and setting up payments. My entire business accounting takes longer. It's not complicated - it's just new."

The System That Makes It Work

Carlos doesn't overcomplicate things. His system has three simple rules:

Rule #1: Set up automatic full payment from his checking account.

"I never want to think about it. The full balance gets paid automatically five days before the due date. Done."

Rule #2: Check his statement monthly for errors or fraudulent charges.

"Takes five minutes. I've caught two subscription services I forgot to cancel this way."

Rule #3: Track business vs. personal spending separately.

"For tax purposes, I need to know what's deductible. So a business card for business, personal card for personal. No mixing."

That's it. No spreadsheets or complicated reward optimization. It's just consistent, simple habits.

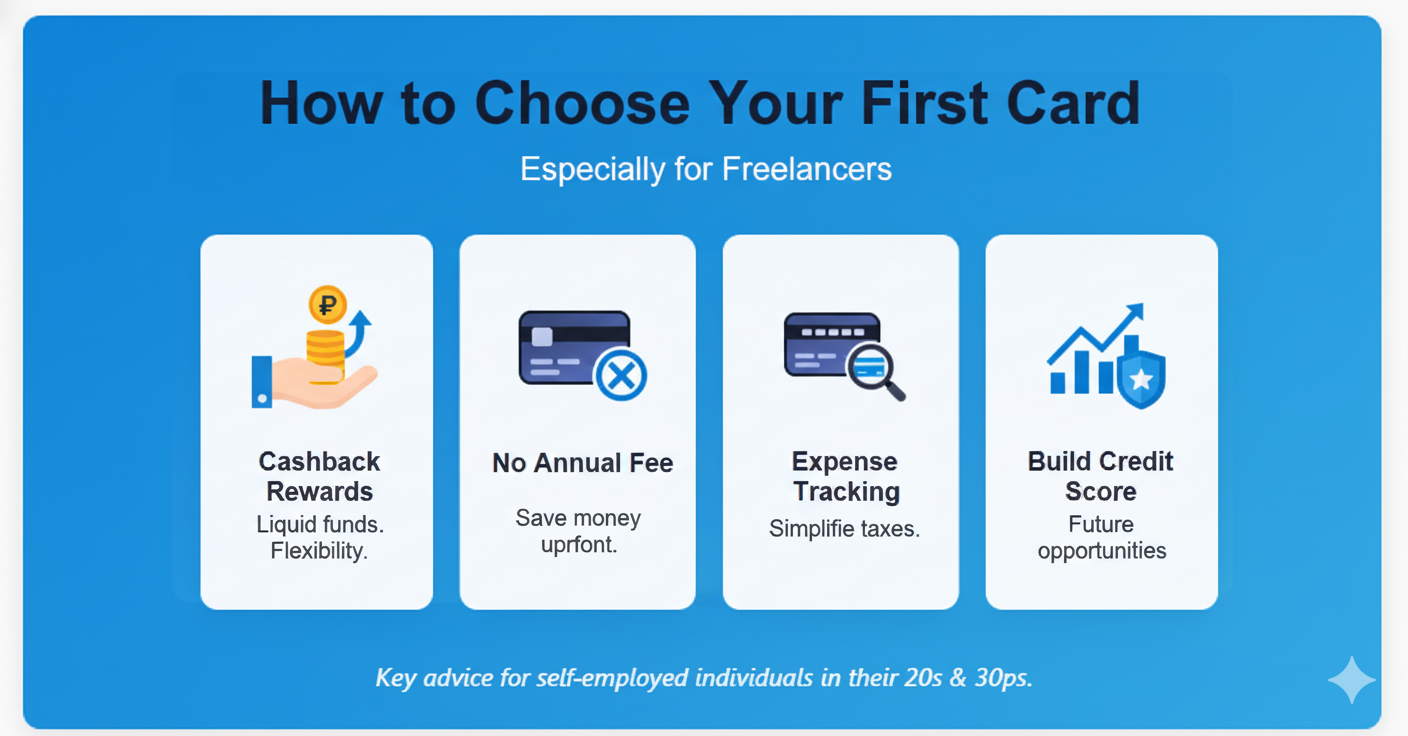

How to Choose Your First Card (Especially for Freelancers)

For guys in their 20s or 30s, especially those with side hustles or freelance income, Carlos has specific advice:

If you have business expenses, get a cashback card first.

"Miles and points are sexy, but cashback is liquid. You can use it for anything. When you're self-employed and income isn't always predictable, cashback gives you flexibility."

Avoid cards with annual fees until you're spending enough to justify them.

"There are excellent no-fee cards out there. Don't pay for a premium card until you're certain the extra rewards outweigh the cost."

Check if the card offers expense tracking or categorization.

"Some cards automatically categorize your spending. As a freelancer, this is gold for tax season."

Look for cards that report to credit bureaus.

"Your credit score matters more than you think. Future you will thank present you for building good credit early."

What He's Earned So Far

In two years of strategic credit card use, Carlos has:

- Earned over ₱45,000 in cashback

- Bought a new monitor, mechanical keyboard, and noise-cancelling headphones entirely with rewards points

- Built his credit score to a level where he qualified for a low-interest personal loan (which he used to upgrade his freelance setup)

- Simplified his business expense tracking significantly

"The cashback alone has paid for my entire office setup," he says. "Equipment I would've bought anyway, but essentially at a 5-10% permanent discount."

His Best Advice for Getting Started

If Carlos could talk to his younger self, here's what he'd say:

"Start with one card. Use it for everything you're already spending money on. Pay it off in full every month. That's it."

No need to optimize across five cards. No need to chase sign-up bonuses or to overthink it.

"The biggest mistake isn't choosing the 'wrong' card," he says. "It's not getting one at all when you're already spending the money anyway."

Carlos' lessons

For Carlos, credit cards stopped being scary once he realized they weren't about spending more. They were about making his existing spending work harder.

"I'm not buying stuff I don't need," he explains. "I'm just getting paid back for buying the stuff I was going to buy regardless."

Two years in, he's turned his freelance expenses into a self-funding system. His software subscriptions essentially pay for his new gear. His client dinners fund his weekend entertainment.

And he's never paid a single peso in interest.

Maybe it's time you did the same.

Ready to find the right credit card for your lifestyle and spending patterns?

Compare the best cards in the Philippines at NerdCash.ph.

Compare Credit Cards