What to Do When Your Credit Card App or Bank Support Fails

Bank app down or customer support unresponsive? Learn how Filipinos should protect their money and respond calmly when banking systems fail.

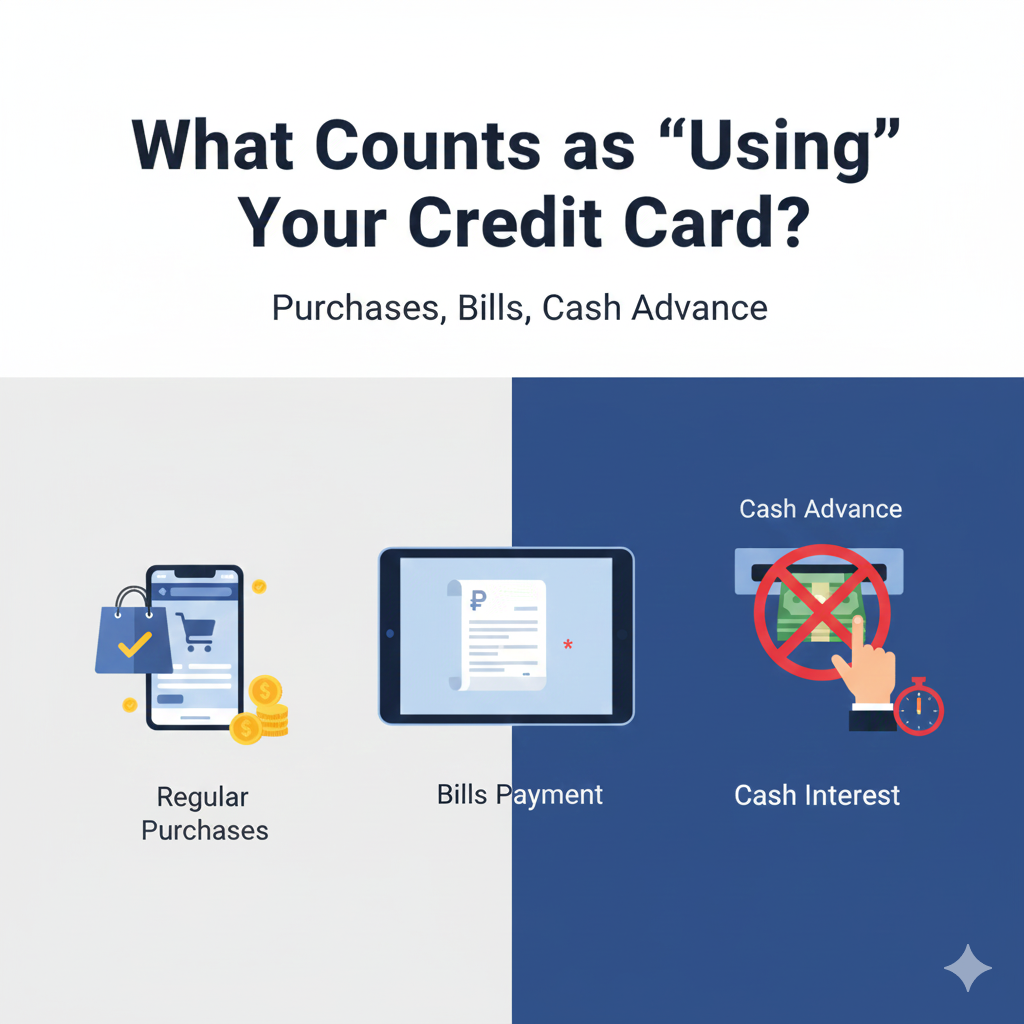

Does paying bills count as credit card usage? Learn which transactions earn rewards, trigger fees, or accrue interest.

I still remember the first time I got hit with a cash advance fee.

I withdrew ₱3,000 from an ATM using my credit card because I was short on cash. Figured it was the same as any other transaction.

Next month's statement came. ₱200 fee plus interest starting from day one. No grace period. No rewards.

That ₱3,000 withdrawal ended up costing me ₱3,350 by the time I paid it off.

Here's what nobody tells you clearly enough. Not all credit card transactions work the same way.

Some earn rewards and follow normal billing cycles. Some charge fees immediately. And some start accruing interest the second you swipe.

The question "What counts as using my credit card?" shows up on r/PHCreditCards all the time. And it matters because the transaction type completely changes how it's treated by your bank.

Understanding this can save you thousands in fees and interest charges.

If you're new to credit cards, start here:

Credit Cards for Beginners in the PhilippinesLet's start with the easiest category: regular purchases.

Philippine bank terms and conditions define these as "retail purchases" or "straight charges." This is normal shopping, dining, and online transactions that post to your statement.

What counts as a regular purchase:

These transactions work exactly how you'd expect.

They appear on your statement. They usually earn rewards if your card has a rewards program. They follow standard billing cycles with a grace period. And if you pay your full statement balance before the due date, you pay zero interest.

Retail transactions enjoy a grace period if you pay your total amount due in full. This is the type of usage credit cards were designed for.

Here's the rule: if you're buying something and the merchant processes it as a normal sale, it's a regular purchase. Simple as that.

My friend Ana uses her BDO card for literally everything: groceries, Grab rides, online shopping, and even her Spotify subscription. As long as she pays in full every month, she earns cashback and pays zero interest.

That's the sweet spot. Use your card like a debit card, pay in full, and collect rewards.

This is where things start to get interesting.

Some billers in the Philippines accept credit card payments. Utilities, internet bills, mobile plans, government payments, insurance premiums, and even tuition fees at some schools.

But here's what you need to know. Not all bills payments are treated the same.

Many billers charge convenience fees. And some credit card issuers don't give rewards on bills or auto-charge facilities, even though the transaction posts to your statement like a normal purchase.

Let me break this down with real examples.

Here's what I learned the hard way. I set up auto-charge for my internet bill on my credit card. Paid on time every month, felt organized. Then I noticed I wasn't earning any rewards points on those payments.

Checked the fine print. Bills paid through auto-charge facilities don't qualify for rewards on my specific card.

The transaction still appeared on my statement. I still got the grace period. But no cashback, no points.

Some banks even run promos specifically for bills payment. Just make sure you're not paying more in fees than you're getting in rewards.

Remember, fees and rewards rules are card-specific and channel-specific. What works for one bank might not work for another.

For more on this, check out: Best Credit Cards for Paying Bills in the Philippines.

Installment transactions are a different beast entirely.

This is when you take a straight purchase and convert it into fixed monthly payments. Sometimes at 0% interest, sometimes with interest, depending on the promo.

Local banks offer 0% installment promos at partner merchants. You'll see these everywhere. "0% interest for 6 months!" or "Pay in 12 months, walang dagdag!"

Here's how it actually works.

According to bank promo pages and terms, here's what you need to know about installments:

The good: You spread out a big purchase over time. Some promos truly have 0% interest. It helps with cash flow management.

The not-so-good: You lose flexibility. You're locked into those monthly payments. Some banks don't award rewards on converted installment amounts. And if you miss a payment, you can get hit with penalties or interest on your whole balance.

Real Example: Ben bought a washing machine on 12-month installment through his credit card. ₱24,000 total, ₱2,000 per month at 0% interest.

Seemed like a great deal. Until month 8 when he lost his job.

He still owed ₱8,000 in installments. He couldn't pay the minimum amount due on his card because the installment was part of it. He had to scramble to borrow money from family to avoid getting hit with late fees and interest on his entire balance.

The lesson: installments are useful, but only if you're 100% sure you can commit to the monthly payments for the entire period.

Here's the rule on installments. Only use them for things you were going to buy anyway and could technically afford to pay in cash. Never use installment as a way to buy something you can't actually afford.

If you wouldn't buy it in cash today, don't put it on installment.

Now we get to the dangerous territory. Cash advances.

A cash advance is when you use your credit card to get cash instead of making a purchase.

What counts as a cash advance in the Philippines:

BSP's fee table and multiple Philippine banks (BPI, Metrobank, Bank of Commerce, HSBC) all show a consistent pattern for cash advances.

Avoid cash advances unless it's an absolute emergency.

For more on what to avoid, check out: Credit Card Fees You Should Know.

There's one more category worth mentioning: quasi-cash transactions.

BSP fee tables and some bank terms explicitly distinguish these from regular purchases. They're transactions that are cash-like but not technically cash advances.

What can count as quasi-cash:

Here's where it gets tricky. Different banks code these transactions differently.

Some banks treat GCash or Maya top-ups as regular purchases. You earn rewards, you get the grace period, it works like buying anything else.

Other banks code wallet top-ups as cash advances or quasi-cash. You get hit with the ₱200 fee, no grace period, no rewards.

There's no universal rule. It depends on your specific bank and how the transaction is processed.

Sofia found this out the hard way. She regularly tops up her GCash using her UnionBank credit card. For months, it worked fine. Earned rewards, paid in full, no issues.

Then her bank changed its policy. Wallet top-ups started getting coded as cash advances. She was charged fees on her next statement and had no idea why.

Treatment of quasi-cash transactions varies by bank and merchant coding, so always verify before assuming a transaction is fee-free.

Let's talk about auto-debit and recurring charges.

These are transactions where you authorize a merchant to automatically charge your card every month. Netflix, Spotify, gym memberships, cloud storage subscriptions.

How these are typically treated:

The benefit is convenience. You never miss a payment. Your subscriptions stay active. You build a consistent payment history.

The risk is forgetting about them.

I once signed up for a free trial of some productivity app using my credit card. Forgot to cancel. Six months later, I'm reviewing my statement and see ₱399 charged every month for something I never used.

That's ₱2,394 down the drain.

Some cards exclude certain auto-debit transactions from rewards programs. Always check if your Netflix subscription is actually earning you points.

One more type of transaction worth covering: foreign currency purchases.

This happens when you shop online from international sites, travel abroad, or buy something priced in dollars or other currencies.

What typically happens:

So if you buy a ₱5,000 item priced in USD and your bank charges a 2% foreign transaction fee, you'll actually pay ₱5,100.

Some premium cards waive foreign transaction fees. If you travel often or shop from international sites regularly, these cards can save you money.

But for most people, the rule is simple. Factor in the foreign transaction fee when deciding if an international purchase is worth it.

Here's the practical part. How do you actually know what type of transaction you just made?

After understanding all these transaction types, here's the strategy that makes sense.

This approach keeps you in control. You use your card as a tool, not as a way to spend money you don't have.

For more foundational advice, check out:

Paying the Minimum vs Paying in FullHere's something most people don't realize. All these transaction types count toward your credit utilization.

Your credit utilization is how much of your available credit you're using. It's calculated as (current balance / credit limit) × 100.

So if you have a ₱50,000 limit and you're currently using ₱15,000, your utilization is 30%.

Financial experts recommend keeping your utilization below 30% for optimal credit scoring. Below 10% is even better.

Every transaction type contributes to this:

If you're constantly maxing out your card or staying above 80% utilization, it can hurt your credit score and make it harder to get approved for loans or higher credit limits in the future.

Remember that ₱3,000 ATM withdrawal I mentioned at the beginning?

It cost me ₱350 in fees and interest because I didn't understand that cash advances are treated completely differently from regular purchases.

One transaction type mistake can cost you hundreds or thousands of pesos.

But once you understand the rules, it's actually pretty simple.

Regular purchases are your friend. Bills payment can be smart if you avoid fees. Installments are useful but commit you to future payments. And cash advances should be avoided at all costs.

Before you swipe, know what type of transaction you're making.

Ask yourself: Is this a regular purchase? Am I paying a bill with a convenience fee? Is this getting coded as a cash advance?

Once you know, you can make an informed decision.

That's the difference between using your credit card strategically and letting it use you.

Your credit card is a powerful tool when you understand how it works. Now you do.