How Credit Card Travel Points Actually Work in the Philippines

Confused about travel points? This beginner-friendly guide explains how credit card travel points actually work in the Philippines — without hype or shortcuts.

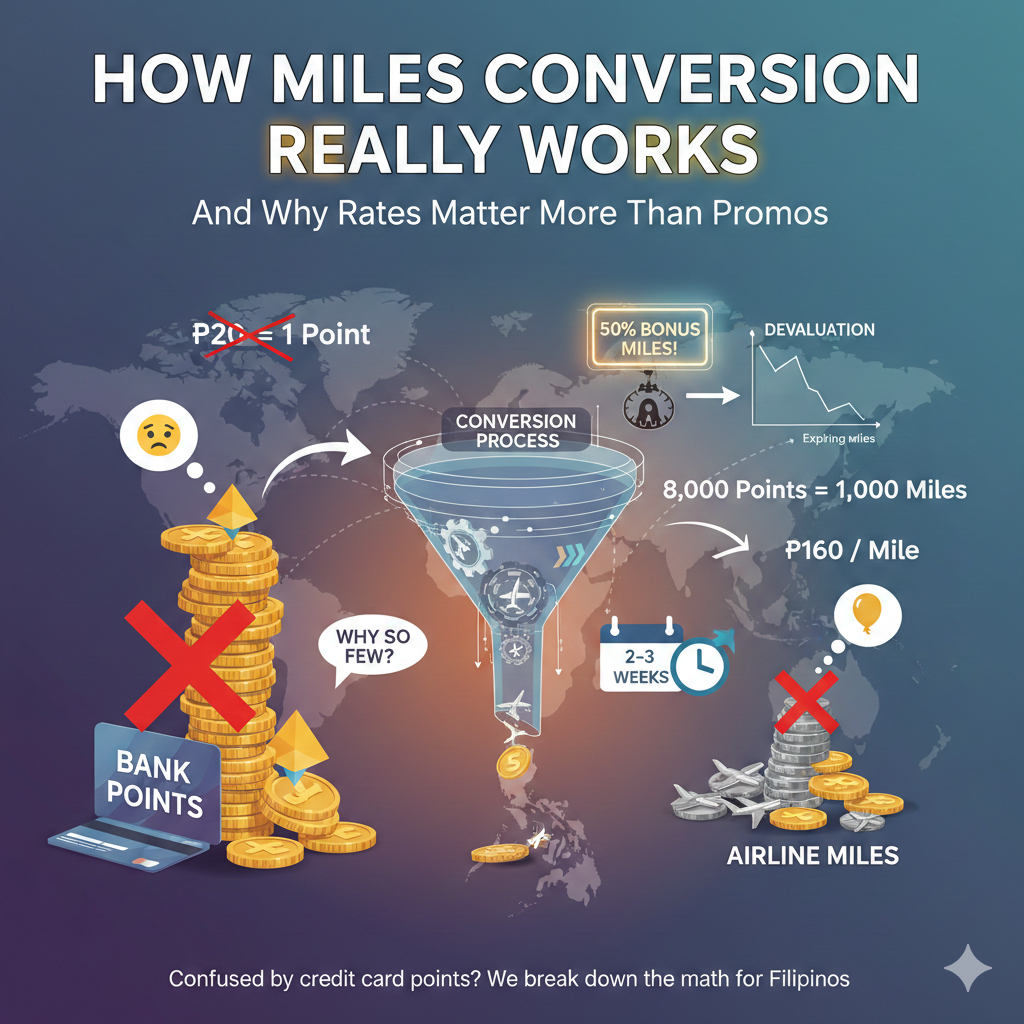

"I Earned a Lot of Points — Why Do I Have So Few Miles?"

It's one of the most common complaints on r/PHCreditCards.

Someone spent months using their travel card consistently. They check their points balance, feel good about the number, then submit a conversion request to their airline program.

The miles that arrive are far fewer than expected.

"Akala ko mas malaki," they write. "After conversion, parang wala na."

This frustration has a name: conversion math. And it's the most overlooked — and most consequential — part of the entire travel rewards system.

Most people focus on how fast they're earning points. Almost nobody checks what happens to those points when they try to turn them into flights.

This article fixes that.

If you're new to travel rewards and want to start from the beginning: 👉 Credit Card Travel Rewards in the Philippines: A Beginner's Guide

Here's how the system works for most Philippine travel credit cards.

You don't earn airline miles directly when you swipe. You earn the bank's own reward points. Those points sit in the bank's system until you decide to convert them. When you do, the bank sends them to your airline frequent flyer account — at a ratio that may or may not be fair.

The journey from your card swipe to a usable flight looks like this:

₱ Spent → Bank Points → Conversion → Airline Miles → Flight

Each arrow in that chain has a ratio. The earning rate is the first ratio. The conversion ratio is the second. Both matter.

But most card marketing shows you only the first one.

Points are not miles until you convert them. And conversion is where a significant amount of value quietly disappears for a lot of Filipino cardholders.

Cards are marketed on earning speed. "Earn 1 point per ₱20." "Fastest miles in the Philippines." "Up to 5x rewards."

Those numbers are technically true. They're also incomplete.

What matters isn't how fast you earn bank points. It's how many airline miles those points become — and how much spending was needed to get there.

Here's the comparison that makes it concrete.

Pauline, a 31-year-old HR manager from Makati, and her officemate Karen both wanted to earn Mabuhay Miles for the same PAL flight. Pauline had a BPI Visa Signature. Karen had a BDO AmEx Explorer.

To earn 1,000 Mabuhay Miles:

Same airline. Same miles program. Same destination. Pauline spent 5.3 times more to get there.

"Hindi ko alam na ganoon ka-layo ang difference," Pauline said. She'd been using her BPI card for two years assuming she was building toward a free flight.

She was. Just at a rate that would take a very long time to get there.

Here's the full picture across the major Philippine travel cards — with the honest effective cost after conversion:

| Card | How It Works | Effective ₱ Per Mile |

|---|---|---|

| EastWest KrisFlyer World (travel/overseas) | Auto-credited to KrisFlyer | ₱12 |

| RCBC Visa Platinum (overseas spend) | Direct conversion | ₱25 |

| Chinabank Destinations World | Direct — no conversion needed | ₱30 |

| Metrobank Travel Visa Signature | Direct — no conversion needed | ₱30 |

| BDO AmEx Explorer | 1 MR point = 1 mile (1:1) | ₱30 |

| PNB Mabuhay Miles World | Direct | ₱33 |

| EastWest KrisFlyer World (dining/online) | Auto-credited to KrisFlyer | ₱38 |

| RCBC Visa Platinum (local spend) | Direct conversion | ₱48 |

| UnionBank Miles+ Visa Signature | ₱30 = 1 UB mile, but 1.6 UB miles = 1 airline mile | ₱48 effective |

| EastWest KrisFlyer World (groceries/utilities) | Auto-credited to KrisFlyer | ₱78 |

| BPI Visa Signature | 8,000 BPI points = 1,000 miles | ₱160 (or ~₱50 with bonus) |

| BDO Visa/MC (non-AmEx) | 5 BDO points = 1 PAL mile | Very poor |

Two entries deserve extra attention.

UnionBank Miles+ is marketed as ₱30 per mile — but earns its own currency first. At 1.6 UB miles per airline mile, the real cost is ₱48. The advertised number and the effective number are two different things.

BDO non-AmEx cards (regular BDO Visa or Mastercard, not the Explorer) convert at 5 BDO Rewards points per 1 PAL Mabuhay Mile, with a minimum block of 2,500 points and 2–3 weeks of processing time. The rate is so poor that the community consistently recommends taking cash credits instead of converting to miles at all.

Even on cards with reasonable conversion ratios, there's another hidden friction: minimum transfer requirements.

You can't convert whatever you have. Most programs require fixed blocks:

| Program | Minimum Conversion |

|---|---|

| BPI → Mabuhay Miles | 8,000 BPI points = 1,000 miles |

| BDO Rewards → Mabuhay Miles | 2,500 points = 500 miles |

| BDO AmEx Explorer → Partners | Usually 1,000 points minimum |

For low spenders, reaching the minimum can take months. In the meantime, points sit idle — not growing, not expiring, just waiting. And occasionally forgotten.

Carlos, a 26-year-old from Quezon City, spent eight months accumulating BPI points before discovering he was still short of the 8,000-point minimum for a conversion. "Akala ko pwede ko na i-convert kahit konti," he said. "Hindi pala." He eventually hit the threshold — but by then, a better-ratio card would have gotten him significantly more miles for the same spending.

Points that can't be converted yet are functionally useless for booking flights. Worth remembering when comparing earning rates across cards.

Here's something that catches first-time redeemers completely off guard.

Conversions are not instant.

BPI to Mabuhay Miles takes up to 15 banking days. BDO Rewards to Mabuhay Miles takes 2 to 3 weeks. Even faster programs have multi-day processing windows.

This means you cannot convert points and book a flight the same day.

Award seats — especially on popular routes to Hong Kong, Singapore, and Tokyo — are limited and often disappear within days of release. If you see availability and your miles are still sitting as bank points, you'll miss it. By the time the conversion processes and the miles land in your account, the seat is gone.

The fix: convert points to miles well before you need them. Don't wait until you're ready to book. Let the miles sit in the airline program — especially if that program has non-expiring miles — and convert early enough that timing is never the issue.

A few times a year, airlines offer bonus miles on point transfers. PAL Mabuhay Miles and KrisFlyer have both run promotions offering up to 50% extra miles on conversions. The forums light up. People rush to transfer.

And sometimes that's the right call. If you were already planning to convert and the timing happens to line up, a 50% bonus is real value.

But here's what actually happens more often.

People convert because the promo exists — not because they have a flight in mind. They transfer a large block of points into an airline program during the limited window. Then they realize award availability for their preferred route is limited. The miles sit. And unlike bank points — which often never expire — airline miles have clocks.

"I converted 20,000 miles to KrisFlyer during a promo," one r/PHCreditCards user wrote. "Ended up not finding flights I wanted. Now I'm watching the expiry date."

The promo created urgency. It didn't create a redemption opportunity.

👉 Why Travel Points Feel Exciting — and How They Make You Overspend

Promos reward speed. Good planning rewards patience. The two are rarely the same thing.

In November 2025, Singapore Airlines increased KrisFlyer redemption costs by 5 to 20% across most routes and cabin classes. Second devaluation in three years.

For Filipino flyers holding EastWest KrisFlyer miles:

The miles earned at ₱12/mile now buy less flight value than they did before November 2025. The earning rate didn't change. The airline changed what those miles are worth.

This is a risk that applies to all airline miles — not just KrisFlyer. Banks can't devalue their own points because points sit in the bank's system. Airline programs can devalue at any time, and they do.

It's one more reason beginners are often better served by bank points with flexible conversion partners than by locking miles directly into one airline program.

👉 Airline Miles vs. Bank Points — What's the Difference?

The choice between bank points and airline miles is really a question of flexibility vs. potential.

Bank points — like BDO Membership Rewards or Metrobank Rewards — sit safely in the bank's system until you're ready to convert. They don't expire. They give you time to research programs, compare redemption values, and wait for the right award availability. The ceiling is lower, but the floor is more forgiving.

Airline miles — already in the airline's program — carry the program's own expiry rules and redemption charts. Higher potential value for premium cabin redemptions. More pressure to use them before the clock runs out or the program devalues.

For beginners, the flexibility of bank points is worth more than the ceiling of airline miles. You have time to learn the system without a deadline hanging over your balance.

👉 Airline Miles vs. Bank Points — What's the Difference?

Most beginners ask: "How many points do I earn?"

The right question is: "How much spending does it take to get a usable flight?"

Using a Manila to Hong Kong round-trip on PAL — 19,000 Mabuhay Miles — as a benchmark:

| Card | ₱ Per Mile | Total Spend Needed |

|---|---|---|

| Chinabank Destinations World | ₱30 | ₱570,000 |

| BDO AmEx Explorer | ₱30 | ₱570,000 |

| RCBC Visa Platinum (local) | ₱48 | ₱912,000 |

| BPI Visa Signature (with bonus) | ~₱50 | ₱950,000 |

| BPI Visa Signature (base rate) | ₱160 | ₱3,040,000 |

That last number is ₱3,040,000. More than three million pesos to earn a Hong Kong round-trip at BPI's base conversion rate.

Nobody shows you that number in the card ads.

👉 The Real Value of Miles (Why 1 Mile ≠ ₱1)

Not every multi-step system is a trap. It's worth it when:

If none of those apply, the simpler path is usually better: cards that earn miles directly — like Chinabank Destinations World or Metrobank Travel Visa Signature — skip the conversion step entirely. You spend, you accumulate, you redeem. Mas simple, mas mababa ang risk ng naiwang points.

Earning points is the easy part.

Converting them well — at the right ratio, at the right time, into the right program — is where most of the value is either kept or lost.

Before you apply for any travel card, find out the effective cost per mile after conversion. Not the advertised earn rate. The number at the end of the full chain: ₱ spent → bank points → airline miles.

That number tells you everything.