Credit Card Travel Rewards in the Philippines

New to travel rewards? This beginner-friendly guide explains how credit card travel points actually work in the Philippines.

"I Finally Have Miles."

Si Carla ay excited na excited.

After two years of swipe-swipe-swipe sa kaniyang card, nakita niya sa app: 18,000 Mabuhay Miles.

"Sapat na 'to para sa ticket papuntang Tokyo," she thought. "Free flight na 'to!"

So she logged into the PAL website. She searched Manila to Tokyo. She found a date she liked.

And then she saw it.

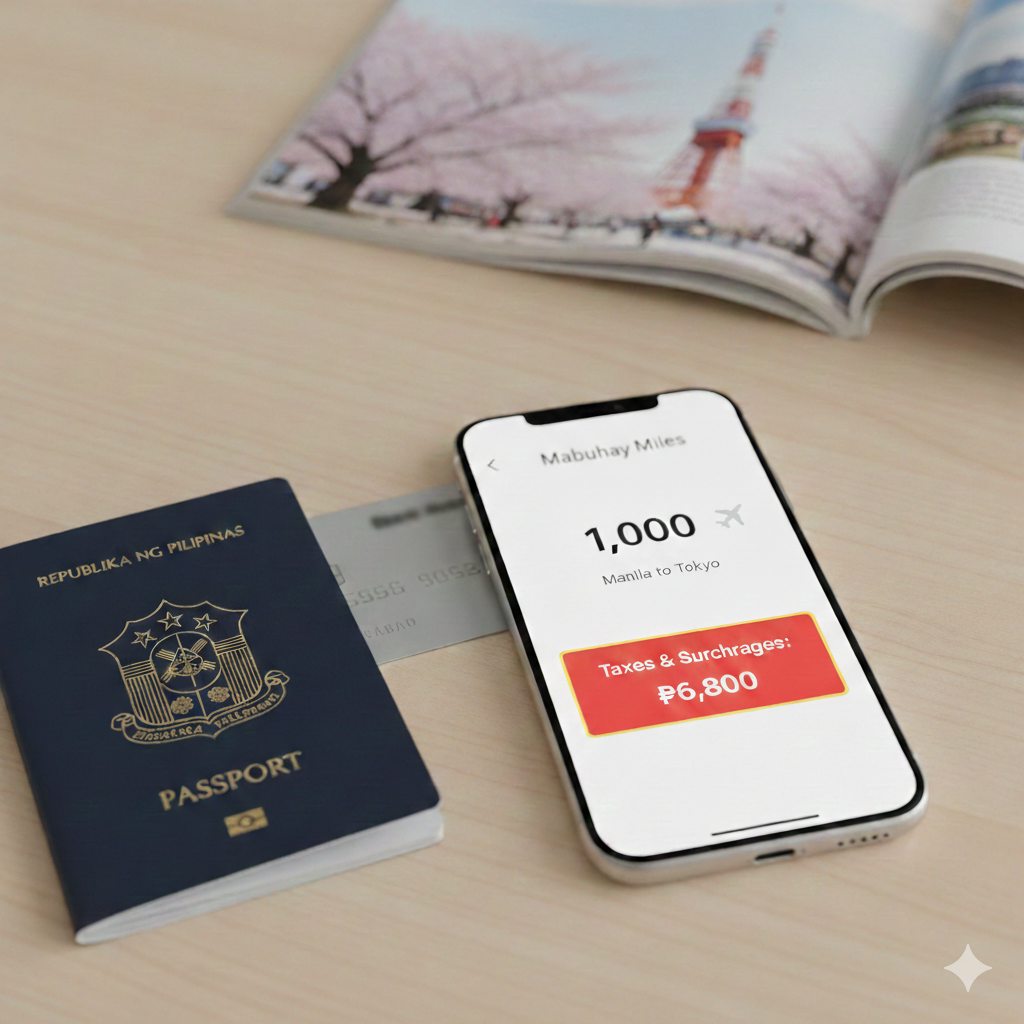

Taxes and surcharges: ₱6,800.

"Ano? Akala ko libre 'to?"

Carla's story plays out every week on r/PHCreditCards. The posts sound familiar:

Redeeming miles is where the excitement meets reality. And for most beginners, reality wins, at least the first time.

This guide exists so you don't have to learn the hard way.

👉 New to travel rewards? Read this first: Credit Card Travel Rewards in the Philippines

Earning miles is passive. You swipe, you earn. Easy.

Redeeming miles is a different game entirely.

It requires planning, flexibility and patience. And you need a realistic understanding of how award tickets actually work.

Here's what most beginners miss: miles are not cash. They're limited vouchers with rules attached. You can't just "book a flight" the way you would on a normal booking site. You're navigating award availability, seat classes, surcharges, and program-specific fine print.

Kaya nga nakakafrustrate. But once you understand the system, it clicks.

Whether you get a great redemption or a disappointing one usually comes down to three things.

Award seats on PAL are separate from regular cash inventory. A flight that's "available" in cash doesn't automatically mean award seats are open and vice versa.

Kung pwede kang mag-adjust ng dates, fly off-peak, or accept a connection instead of a direct flight, your options open up significantly. Your miles become more valuable.

Kung fixed ang dates mo like a specific Holy Week weekend, a specific departure time, it gets much harder. At doon nagsisimula ang frustration.

Award seats are released in waves. Airlines hold some back, release more at certain windows, and replenish when cancellations happen.

Waiting until two weeks before your trip? Maliit na ang chance mo. The earlier you search, the more options you'll find. Checking availability across a flexible date range, not just one specific day, makes a real difference.

Even if you find award availability, miles rarely cover everything. You'll still pay airport taxes, fuel surcharges per segment, and booking fees. Setting realistic expectations before you start searching, instead of after, saves you a lot of "pero akala ko libre" moments.

Redeeming miles just to use them.

"Baka mag-expire na kasi," goes the thinking. So they book a random flight — awkward dates, inconvenient routing — just to "do something" with their miles.

Result: poor value, inconvenient flights, regret.

Here's the good news about Mabuhay Miles specifically: they don't expire on a fixed date. They stay valid as long as you earn or redeem at least once every two years. Even earning miles on a cheap domestic flight resets the clock.

Panic-redeeming is almost never necessary. The better move is to wait for the right opportunity.

👉 The Worst Ways to Use Travel Points (According to Frequent Flyers)

"Good value" doesn't mean you need to score business class to Singapore or nothing. That's the trap of chasing maximum theoretical value.

Practical value beats perfect value.

A good redemption typically means you save meaningful cash, fees and surcharges are reasonable relative to that savings, and you didn't have to compromise excessively on dates or routing.

Classic example of good value: Manila to Tokyo in economy during peak season. Cash fares on PAL can hit ₱25,000–₱35,000 round trip during Golden Week or Christmas. If you find award availability and surcharges come to ₱6,000–₱8,000, you're still saving ₱17,000–₱27,000. That's real money.

Classic example of poor value: short domestic hop during a seat sale. If the cash fare is ₱899 on promo and your award redemption still charges ₱500 in taxes and fees, just pay cash. The miles aren't doing enough work there.

This is the section Carla wishes she read first.

Even on "free" award tickets, PAL charges fuel surcharges per segment, government taxes and terminal fees, and service and booking fees. These apply to adults, children, and seat-occupying infants — so a family booking on miles still pays a significant cash component.

Para sa pamilya na tatlo papuntang Japan? You could easily be looking at ₱15,000–₱25,000 in total fees, even with miles covering the base fare.

There's also this: if you need to rebook a Mabuhay Miles award ticket, fees apply — USD 30 for domestic, USD 40 for regional, USD 50 for international, plus 12% VAT if processed in the Philippines. Miss your flight without cancelling at least 24 hours before? That's a USD 75–125 no-show fee on top of everything.

Hindi ito para takutin ka. It's just reality. Award tickets can absolutely be worth it, but they are not truly free.

👉 Why Travel Rewards Rarely Feel as "Free" as Advertised

Redeem when:

Consider paying cash when:

Miles are a tool. Not an obligation. Knowing when not to redeem is just as valuable as knowing how.

Maraming PH credit cards don't give you airline miles directly. They give you bank reward points first — and you convert those to miles later.

Example: BPI Signature earns BPI Points. To use them with PAL, you convert at 16,000 BPI Points = 1,000 Mabuhay Miles. BDO's Amex Explorer offers a much better 1:1 conversion to Mabuhay Miles.

The difference matters because bank points and airline miles behave very differently as redemption tools.

Bank points are simpler. More flexible. You can often use them for statement credits, local gift cards, or partner rewards — no seat availability issues, no award booking complexity. Lower stress, especially for beginners.

Airline miles have a higher upside, particularly for international flights where cash fares are expensive. But they come with restrictions: availability limits, program rules, change-fee charges, and the complexity of knowing when and how to convert.

Beginners consistently underestimate the stress cost of airline miles. If the thought of researching award availability, managing conversion ratios, and tracking expiry sounds exhausting, it's okay to keep your bank points flexible for now. Learn the system before locking yourself in.

👉 Airline Miles vs Bank Points: What's the Difference?

This is one of the most common mistakes in the Philippines.

The scenario: you accumulate bank points, get excited, convert them to Mabuhay Miles and then discover there are no award seats on the dates you want. Or that you need far more miles than you have for your target route.

Now you're stuck with miles you can't use productively, instead of the flexible bank points you started with.

The rule: only convert when you have a clear target route and date range and have already confirmed that award availability actually exists.

Search first, then convert after.

You don't have to aim for Tokyo on your first redemption. Here's a lower-pressure approach:

Learn the system before aiming high. Your first redemption should teach you how it works — not leave you frustrated.

Mabuhay Miles don't expire on a fixed date. The rule is activity-based: as long as you earn or redeem at least once every two years, your miles remain valid.

Even a small earn — a cheap domestic flight, a partner transaction — resets the clock. So no need to panic-redeem before you're ready.

What you do want to avoid: letting your account go completely dormant for two full years. Set a calendar reminder if you're not flying frequently.

Bad redemptions hurt more than waiting.

Using miles on the wrong flight, awkward dates, high fees, and poor value are worse than holding them until the right opportunity comes along.

The travelers who get the most out of their miles aren't the ones who redeem fastest. They're the ones who redeem the smartest.

Carla eventually booked her Tokyo trip. Not on Holy Week — but in September, off-peak, with award seats available and reasonable surcharges. She paid ₱7,200 in total fees and saved what would have been a ₱28,000 cash fare.

"Sulit naman pala," she said. "Kailangan lang marunong."

That's all this is trying to help you do.