Credit Card Travel Rewards in the Philippines

New to travel rewards? This beginner-friendly guide explains how credit card travel points actually work in the Philippines.

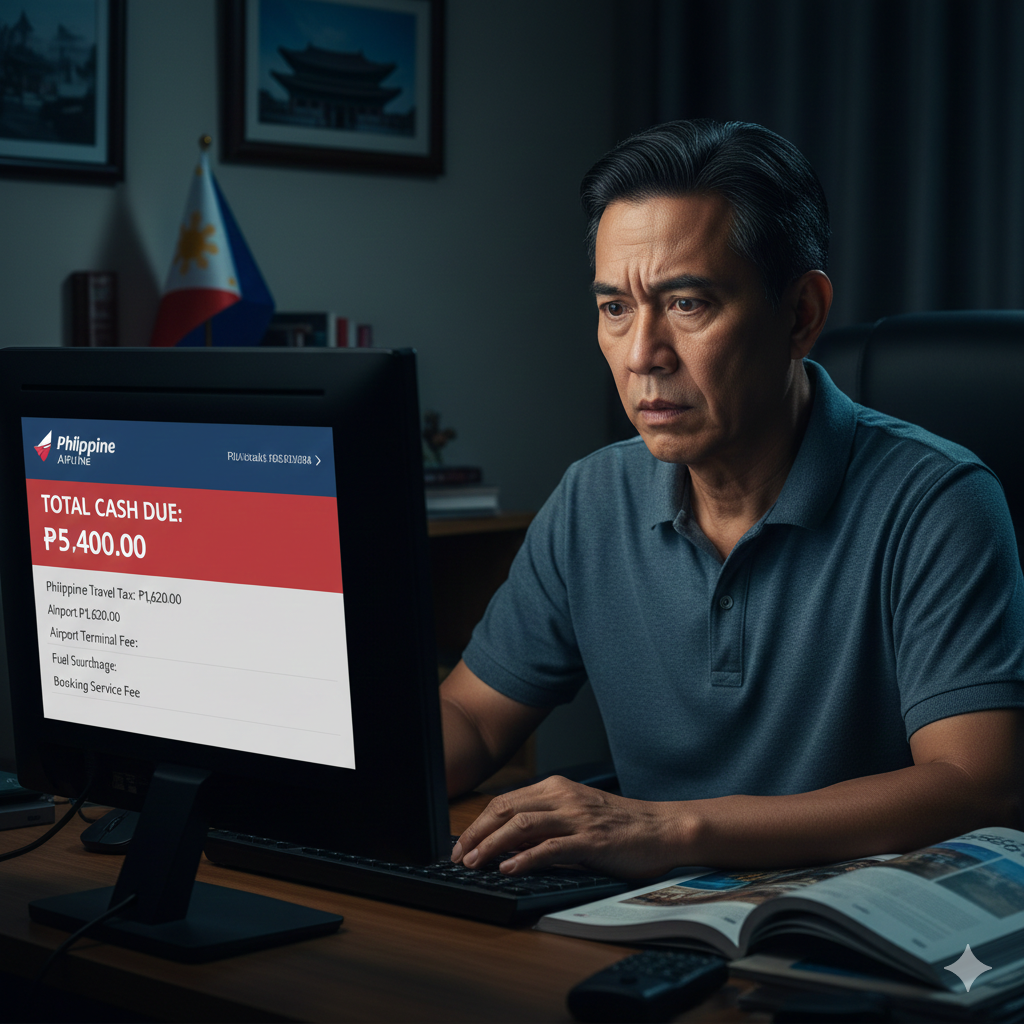

Kuya Nico had been telling everyone about his upcoming trip to Seoul.

"Libre ang flight ko," he'd say. His officemates were impressed. His family was proud. He'd spent two years being careful about which card he used for which purchase, tracking points, reading up on Mabuhay Miles. This was the payoff.

Then he got to the booking confirmation page.

Philippine Travel Tax: ₱1,620. Airport terminal fee. Fuel surcharge. Booking service fee. Total cash due: ₱5,400.

He sat there staring at it.

He paid it. He took the trip. Seoul was wonderful. But for weeks after, he kept thinking about how "libre" didn't quite mean what he thought it meant. And he felt a little embarrassed about how confidently he'd told everyone it was free.

This feeling is probably the most common quiet disappointment in Philippine travel rewards. Not fraud. Not a scam. Just a gap between what the marketing implied and what the experience actually cost.

This article is about that gap — why it exists, why it surprises so many people, and how to set better expectations so the disappointment doesn't happen to you.

👉 Credit Card Travel Rewards in the Philippines

Travel rewards marketing is very good at one thing: leading with the upside.

"Earn a free flight." "Redeem for complimentary travel." "Your next vacation, on us."

These lines work because they're not technically lies. You really can use miles to book a flight without paying the base fare in cash. That part is real.

What the marketing leaves out is everything else. The taxes. The surcharges. The fees for changing or cancelling. The annual fees on the card that made earning those miles possible. The hours spent researching availability. The constraints around dates and routes.

Travel rewards are not free. They are subsidized. You earn them through spending, and you unlock them through a system with rules. At their best, they're a meaningful discount on travel you were going to do anyway. That's genuinely valuable. But it's a different thing from free.

The word "free" sets an expectation that the actual experience can't meet. And that's where the disappointment begins.

The biggest one, for most first-time Mabuhay Miles users, is taxes and surcharges.

PAL is upfront about this in their terms — award tickets still require you to pay applicable taxes, fees, and surcharges at the time of booking. But most people don't read the terms before they get excited about the marketing. So the first time they actually go to redeem, the cash total on the booking page is a shock.

On a Manila to Incheon round trip, for example, the out-of-pocket costs on an award ticket can exceed USD 100 when you add Philippine Travel Tax, airport fees, and fuel surcharges. That's real money, even if the base fare is covered by miles.

And it doesn't stop there. If your plans change and you need to rebook, PAL charges USD 30 to USD 50 for award ticket changes depending on the route, plus 12% VAT if processed in the Philippines. Miss your flight without cancelling at least 24 hours before? That's a USD 75 to USD 125 no-show fee per sector.

None of this makes the system broken. These are the rules, and they're documented. But they're not what people picture when they imagine a "free flight."

👉 How to Redeem Airline Miles Without Wasting Them

This one gets overlooked almost completely.

Getting real value from travel rewards takes work. You need to understand your card's earning rates. Know how your bank points convert to airline miles — and at what ratio. Track expiry dates. Search award availability across a flexible date range. Compare total out-of-pocket costs against cash fares. Understand rebooking rules before committing.

For people who enjoy this kind of thing, it's almost a hobby. They find it fun. And that's completely valid.

But for people who just wanted a discount on their next vacation, the learning curve is real. Many Filipinos in loyalty programme surveys report finding redemption rules confusing — complex caps, partner rules, expiry conditions — and either don't redeem at all or redeem badly after putting in significant time and mental energy.

Time has value. Stress has value. If navigating a rewards programme takes you five hours and causes three arguments with your travel companion about whether the dates work, that's a cost. It just doesn't appear on your bank statement.

Here's the angle that rarely makes it into rewards marketing.

Every peso you spend on a credit card to earn points is a peso that could have been saved, invested, or used with full flexibility. Rewards programmes are designed to encourage spending. That's the business model. And it works — people genuinely do spend more when they're chasing points.

A 2025 survey found that 72% of Filipinos feel their credit card rewards don't match their lifestyle or financial goals. A big part of that mismatch is that people accumulated points through spending patterns that weren't serving them financially, hoping the rewards would eventually pay off.

Sometimes they do. But sometimes the "free flight" was funded by three years of slightly overspending across dozens of purchases — and the math, if you actually did it, wouldn't look as good as the booking confirmation implied.

Rewards are not income. They're a partial rebate on spending. The distinction matters.

👉 Why Travel Points Feel Exciting — and How They Make You Overspend

This one is easy to forget once you've had a card for a while.

Most travel cards with meaningful miles earning or lounge perks charge annual fees in the ₱4,000 to ₱5,000 range. Some waive the first year, which makes it easy to sign up without thinking about the long-term cost. But from year two onwards, that fee is real.

If you're paying ₱5,000 a year in annual fees and you only take one trip where you use miles — and the surcharges on that trip come to ₱5,000 — then you've spent ₱10,000 total for a flight that "cost you nothing."

Was the base fare worth more than ₱10,000? If yes, you came out ahead. If not, you didn't.

Filipino users in card forums regularly describe this feeling — "hindi sulit" — when they add everything up at the end of the year and realise the rewards didn't quite justify the fees. The annual fee is part of the cost of the system. It should be part of the calculation.

👉 Annual Fees on Travel Cards: When Are They Actually Worth Paying?

Beginners approach travel rewards with the most optimism and the least information. That's not a character flaw — it's just where everyone starts.

The mental picture is usually something like: earn points, book flight, fly for free. Clean. Simple. Exciting.

The actual experience involves checking award availability across multiple dates, discovering that the flight you want has no award seats, converting bank points at a not-great ratio, paying several thousand pesos in taxes and fees, and navigating a rebooking policy you've never read before.

It's not impossible. Plenty of people do it every year and get genuine value from it. But it's not the frictionless experience the welcome email suggested. And that gap — between the imagined version and the actual version — is what creates disappointment.

Cashback is boring. There's no other way to put it.

A 0.5% to 2% rebate on your spending doesn't make for an exciting credit card advertisement. Nobody posts on social media about getting ₱800 back as a statement credit. There's no story to tell.

But cashback is honest. It does exactly what it says. You spend money, you get a small percentage back, no rules attached. No availability to check. No surcharges to calculate. No annual calendar of blackout dates to navigate.

Travel rewards, by contrast, are genuinely exciting when they work well. Using miles for a Manila to Tokyo flight during peak season and saving ₱20,000 in cash — that's a real, meaningful win. It's the thing the marketing promises, and sometimes it actually delivers.

The difference is that cashback is reliably fine, while travel rewards are conditionally great. One is consistent. The other requires the right conditions.

For a lot of Filipinos — especially those who travel once or twice a year, don't want to spend time on rewards strategy, and just want a card that quietly gives something back — cashback is actually the better fit. Not because travel rewards are bad, but because the honest version of travel rewards requires more effort than they're willing to put in.

👉 Cashback vs Miles: Which Is Better for Filipino Travelers?

After all of that, it's worth being clear: travel rewards can genuinely deliver.

They feel worth it when the flight you're replacing with miles is expensive enough that the savings are meaningful — long-haul routes, peak season, destinations where cash fares hurt. When the surcharges are reasonable relative to what you're saving. When you found award availability that worked for your schedule without too much compromise. And when you went in with accurate expectations and weren't surprised by anything.

Kuya Nico's Seoul trip, for the record, was still a good redemption. The base fare on that route during the dates he wanted was around ₱18,000 one way. He paid ₱5,400 in fees and taxes. He saved over ₱12,000 compared to a cash booking.

He just wishes someone had told him to expect the ₱5,400 before he started telling everyone the flight was free.

The reframe that makes travel rewards less disappointing — and more useful — is simple.

Stop thinking of them as "free." Start thinking of them as a discount with conditions.

Sometimes the discount is large and the conditions are manageable. That's a good redemption. Sometimes the discount is small and the conditions are annoying. That's a bad one. Most redemptions fall somewhere in between.

When you hold that framing, the goal becomes finding redemptions where the discount is meaningful and the conditions don't create too much friction. Not chasing "free." Not optimising for maximum theoretical value. Just looking for cases where the miles actually do useful work.

That's a much more achievable target. And it's one that can actually be met.

The right question to ask before any redemption isn't "is this free?"

It's: "Is the value I'm getting worth the cash, the time, and the trade-offs involved?"

Sometimes the answer is a clear yes. Sometimes it's no. Often it's somewhere in the middle. But asking that question — honestly, before you book — is what separates a satisfying redemption from a ₱5,400 surprise on a confirmation page.

Libre is a nice word. It's just rarely the accurate one.